Trading Strategies

Bollinger Band Strategy

Bollinger bands are easy to use and can replace trend channels as the indicator shows the range where the price mostly moves. Working with Bollinger bands you can use a signal: when the price sharply breaks the band it tends to return back to the central indicator line.

A procedure after a signal appearance:

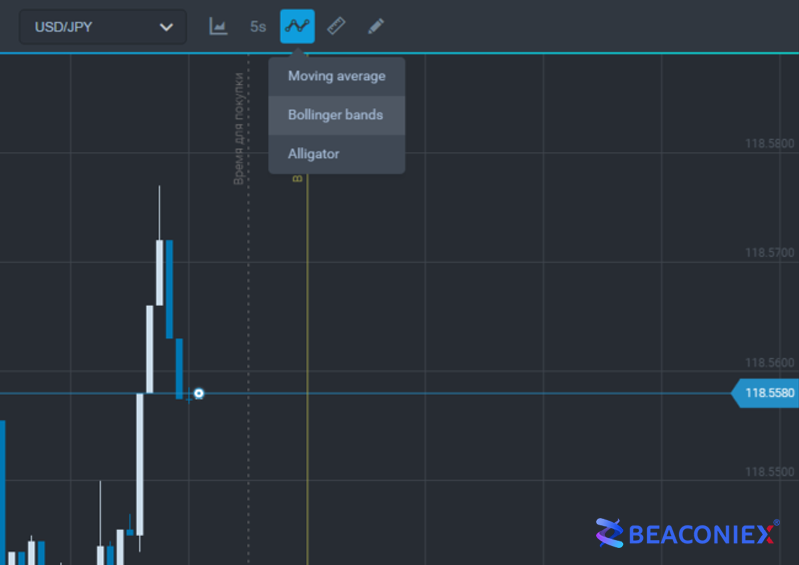

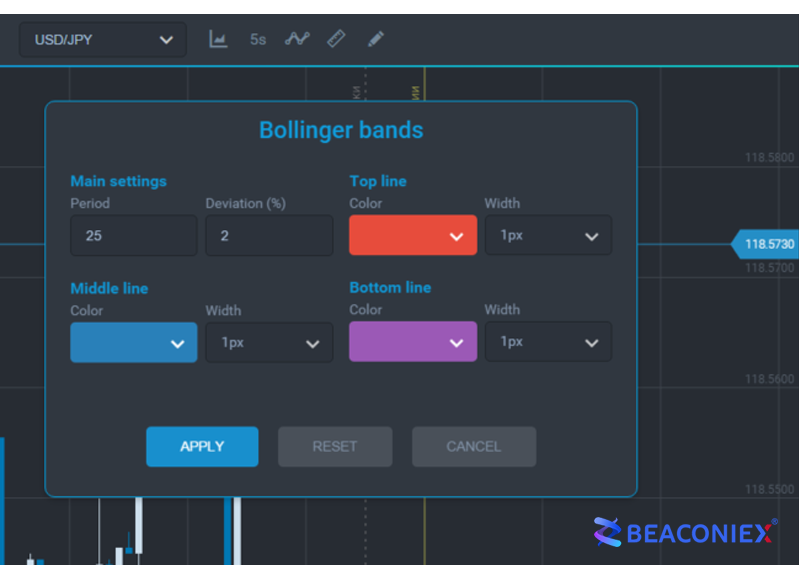

1) Add Bollinger band indicator to the price chart;

Indicator Settings

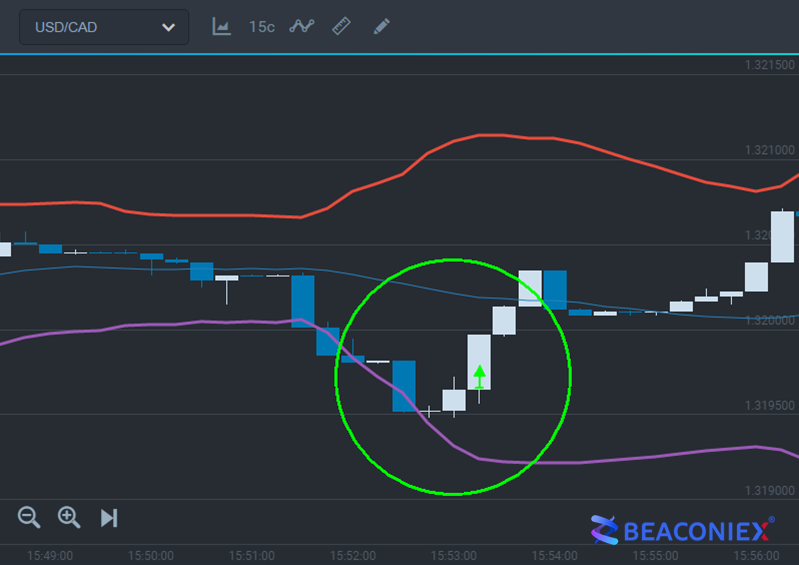

2) Wait when the price has moved outside the indicator;

3) After the price has returned inside and a confirming candlestick has been closed we can open a deal directed towards the central indicator line;

The upper and lower Bollinger bands can be used as the levels of support and resistance.

A procedure after a signal appearance:

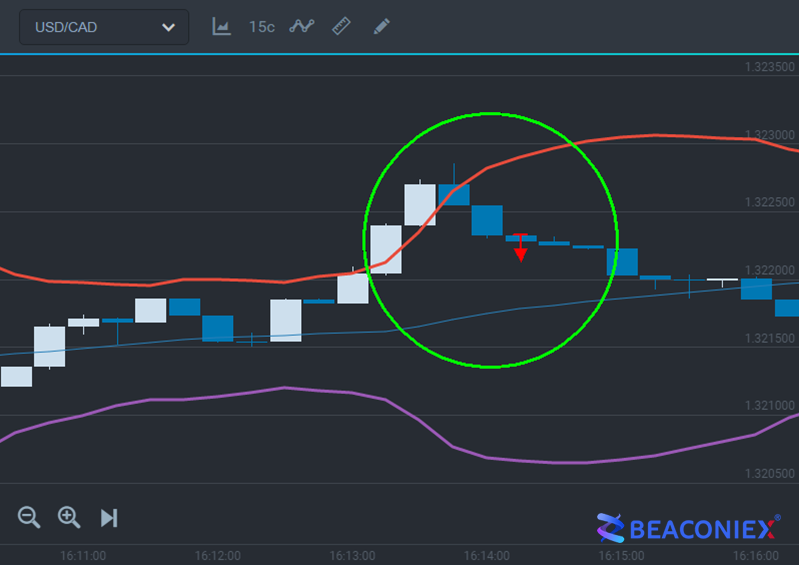

1) The price is closed at the upper/lower indicator line;

2) A new candlestick moves in reverse direction;

3) Wait for a confirmation and trade directed towards a central indicator line.