Trading Strategies

Reversal Strategy

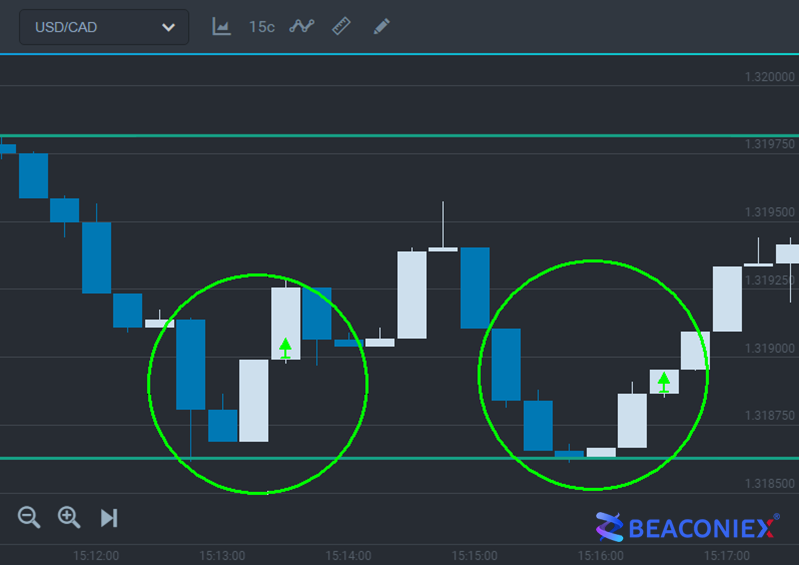

The main aspect of this strategy is that we open a deal after a price movement reversal. A trading signal will be a candlestick having reached the level and failed to be closed outside it. A candlestick can touch the level by its shade or body. Breaking a strength level by a candlestick shade and closing inside the level shows that the price is not able to break out it. A signal confirmation will be a new candlestick following it and moving in a reverse direction.

A procedure after a signal appearance:

1) A candlestick was not able to be closed outside the level and touched it by its shade or body;

2) Wait for a confirmation – when the second candlestick bounces off the level;

3) Trade online in the reverse direction.

Remember you can find many support and resistance levels on the chart but only the levels confirmed by the price will affect the price in future. To check a strength level is easy enough: you should review the price history and see how often the price stopped or reversed at this level. If the price “has not noticed” the level no need to consider it in your analysis.